To give you a sense of the role exemptions played in healthcare some 127 million Americans claimed at least one exemption in 2015. To help do that the ACA authorized the federal government to issue tax credits or subsidies to people with low or moderate incomes who buy health plans sold on government-run Obamacare exchanges.

Who Isn T Eligible For Obamacare S Premium Subsidies Healthinsurance Org

Who Isn T Eligible For Obamacare S Premium Subsidies Healthinsurance Org

If a persons income is below the tax filing threshold they are exempt if the cheapest plan costs more than 8 MAGI they are also exempt.

What income level is exempt from obamacare?. This includes for example individuals earning up to 15417 annually or say a family of three with a household income of up to 26347 annually. How the Obamacare Medicare Tax works There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross income AGI. Under Obamacare Medicaid was expanded to include low-income individuals and families living with earnings up to 138 of the federal poverty level.

For married couples the cutoff is 24400. Federal tax filing thresholds are 10150 single and 20300 married an filing jointly. If you dont have coverage you dont need an exemption to avoid the penalty.

12000 for single individuals under age 65 and 24000 for those under 65 who were married and filing jointly. People purchased their policies and Medicaid which is a program for the lower income group in America expanded rapidly. The fee for not having health insurance no longer applies.

For single filers the threshold is just 200000. For 2016 individuals with annual taxable income between 11770 and 47070. Exemptions from the requirement to have health insurance.

In general there is thinking or sense of thought that Obamacare has only affected or has made a. Individual health plans require a minimum income level. 21 rijen Divorces and separations finalized before January 1 2019.

This is a very common question this tax season especially with recent charges in the Affordable Care Act. If your income is so low that you arent required to file a tax return then youre automatically exempt from the penalty. If youre 30 or older and want a Catastrophic health plan you must apply for a hardship exemption to qualify.

For example if a single taxpayers income in 2019 is less than 12200 there typically was no need to file a return. Obamacares exemptions are codified in Section 5000A of the tax code. The eight percent rule provides an exemption when the lowest cost insurance exceeds 8 percent of annual income.

What income level is exempt from Obamacare. Another example of the marriage penalty at work in our tax code. A list of ObamaCares Exemptions including Hardship Exemptions you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below.

If there are members of the household unit with no income then they could not qualify for individual health plans. Those people couldnt pay the penalty because the penalty was imposed in the form of a taxno. As per the mandates anyone who is detained for a minimum of one day in any recognized correctional facility is exempt from the requirement for the month in which they were detained.

For the 2018 tax year filing thresholds were. 3 These exemptions could be for things like not having enough income to owe income taxes. You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year.

For example beginning from the 2020 tax year people without health insurance that qualifies as minimum essential coverage will no longer have to apply for an exemption or pay a penalty for not having a cover. Supplemental Security Income for severely disabled blind and poor residents is not income for Obamacare purposes. When insurance costs exceed the range provided by rule for affordable coverage individuals may be exempt from the mandate.

Once you are released from custody you will then. There are nine explicit exemptions. What income level is exempt from Obamacare.

This page just covers the basics see our page on ObamaCare Exemptions for further details on exemptions and the fee active on plans held in 2014 2018 in all states. It revamped the individual insurance market. According to the law the people who do not have to comply with Obamacares mandate and who will not face any penalty for noncompliance are.

A similar result occurs when employer-sponsored coverage exceeds 95 percent of annual income. There are many options for getting affordable coverage on the federal or state marketplaces but affordable is relative. In your specific case if someone spends more than 330 days outside the country or has foreign insurance they are exempt.

If a marketplace or job-based insurance plan will cost you more than 816 percent of your household income then youre exempted from. To qualify for an Obamacare tax credit you have to estimate your household income for the following year in your application. Your income doesnt meet tax-filing requirements this amount varies by age and filing status.

Understanding The Budget Revenues

Understanding The Budget Revenues

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

2021 New York Essential Plan Income Guideline Safe Policies Insurance

2021 New York Essential Plan Income Guideline Safe Policies Insurance

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

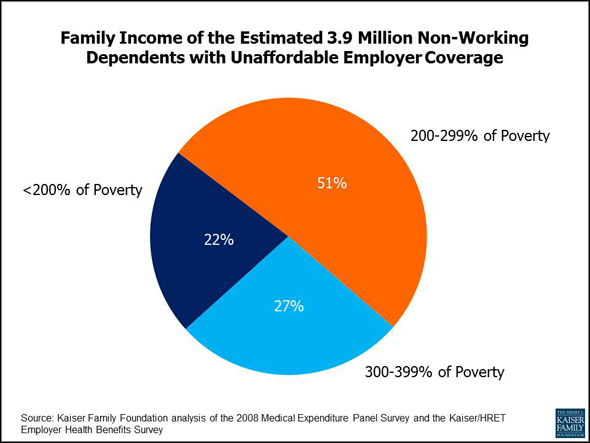

What Is Affordable Employer Coverage Under Obamacare

What Is Affordable Employer Coverage Under Obamacare

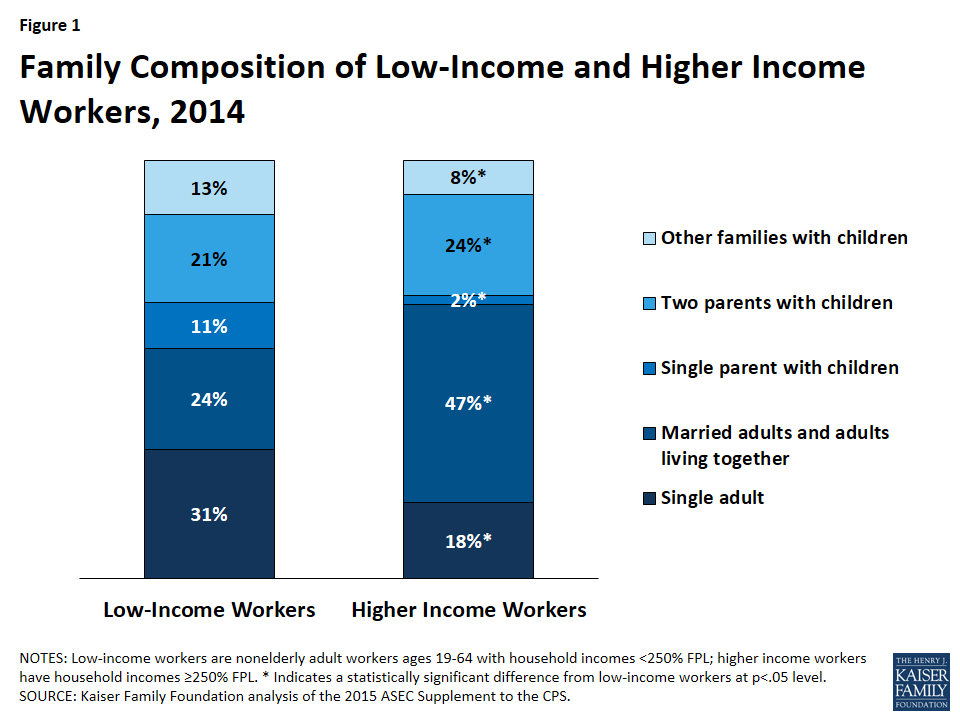

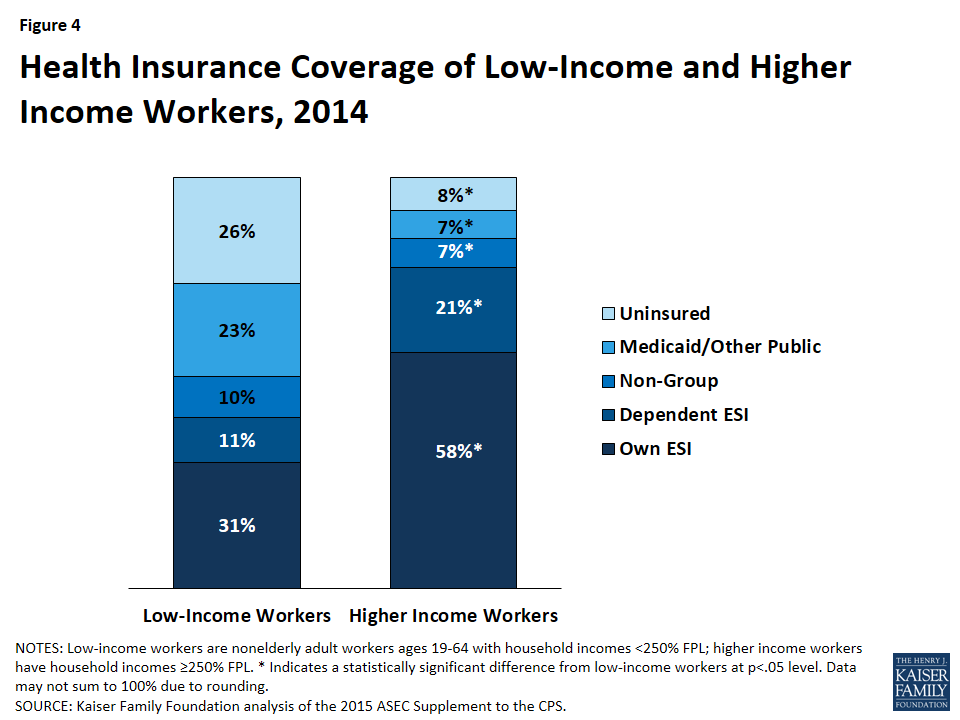

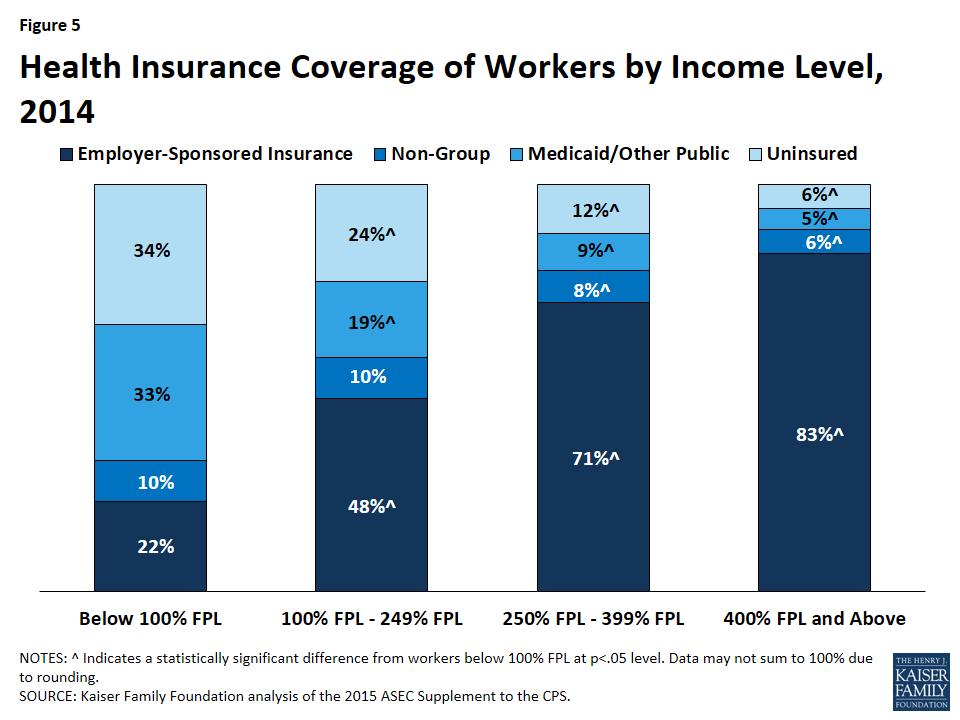

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

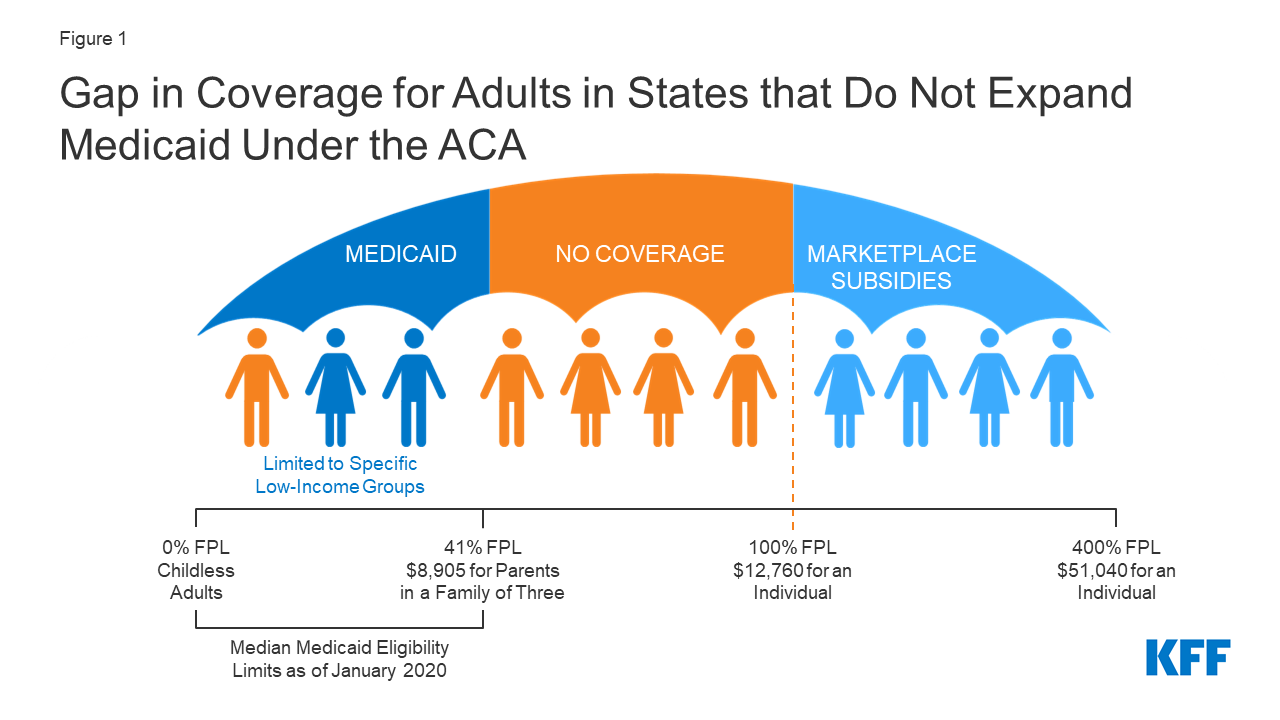

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

This Timeline Of The Affordable Care Act Outlines When Key Features Of The Law Were Implem Health Quotes Motivation Health Care Reform Private Health Insurance

This Timeline Of The Affordable Care Act Outlines When Key Features Of The Law Were Implem Health Quotes Motivation Health Care Reform Private Health Insurance

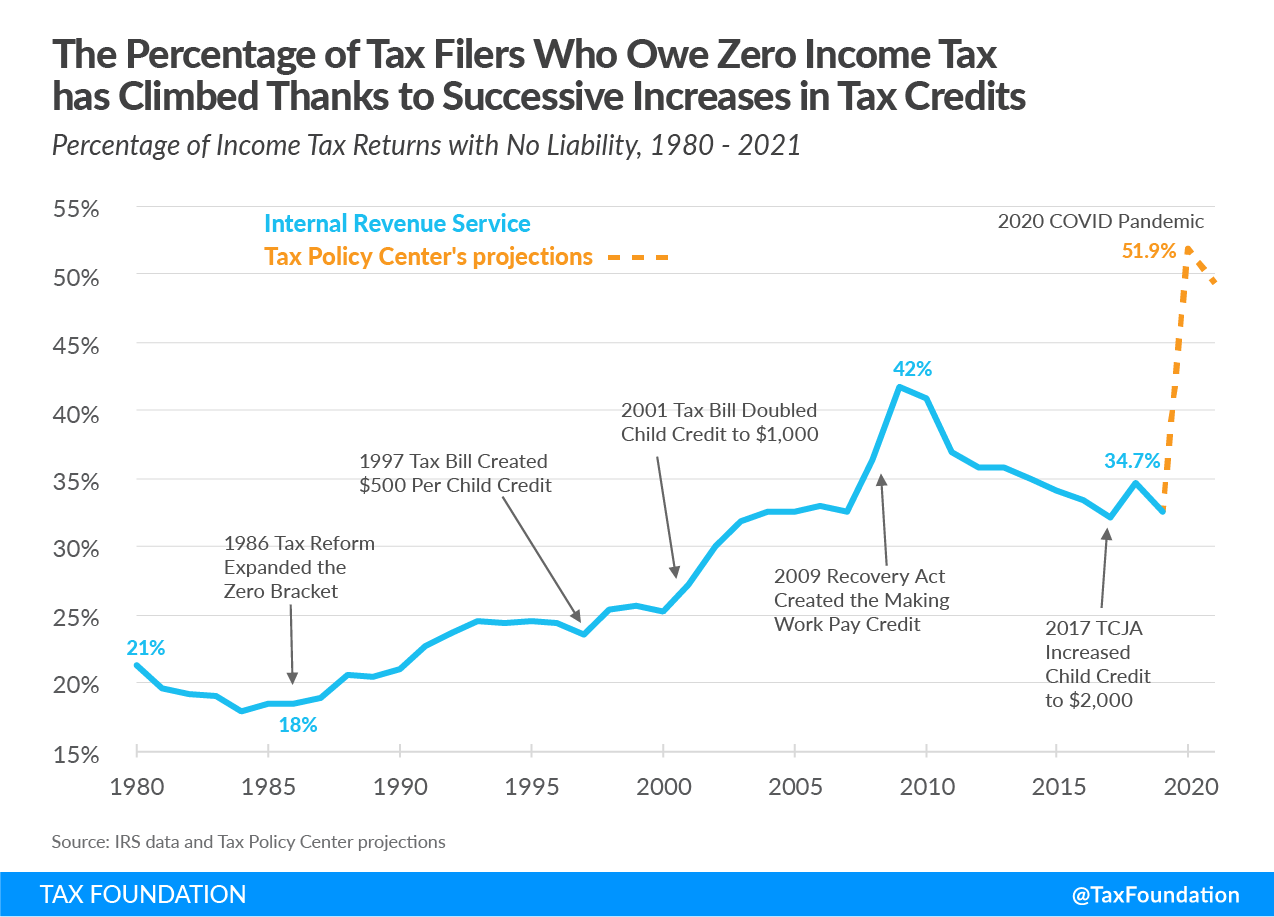

Increasing Share Of U S Households Paying No Income Tax

Increasing Share Of U S Households Paying No Income Tax

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Covered California Income Tables Imk

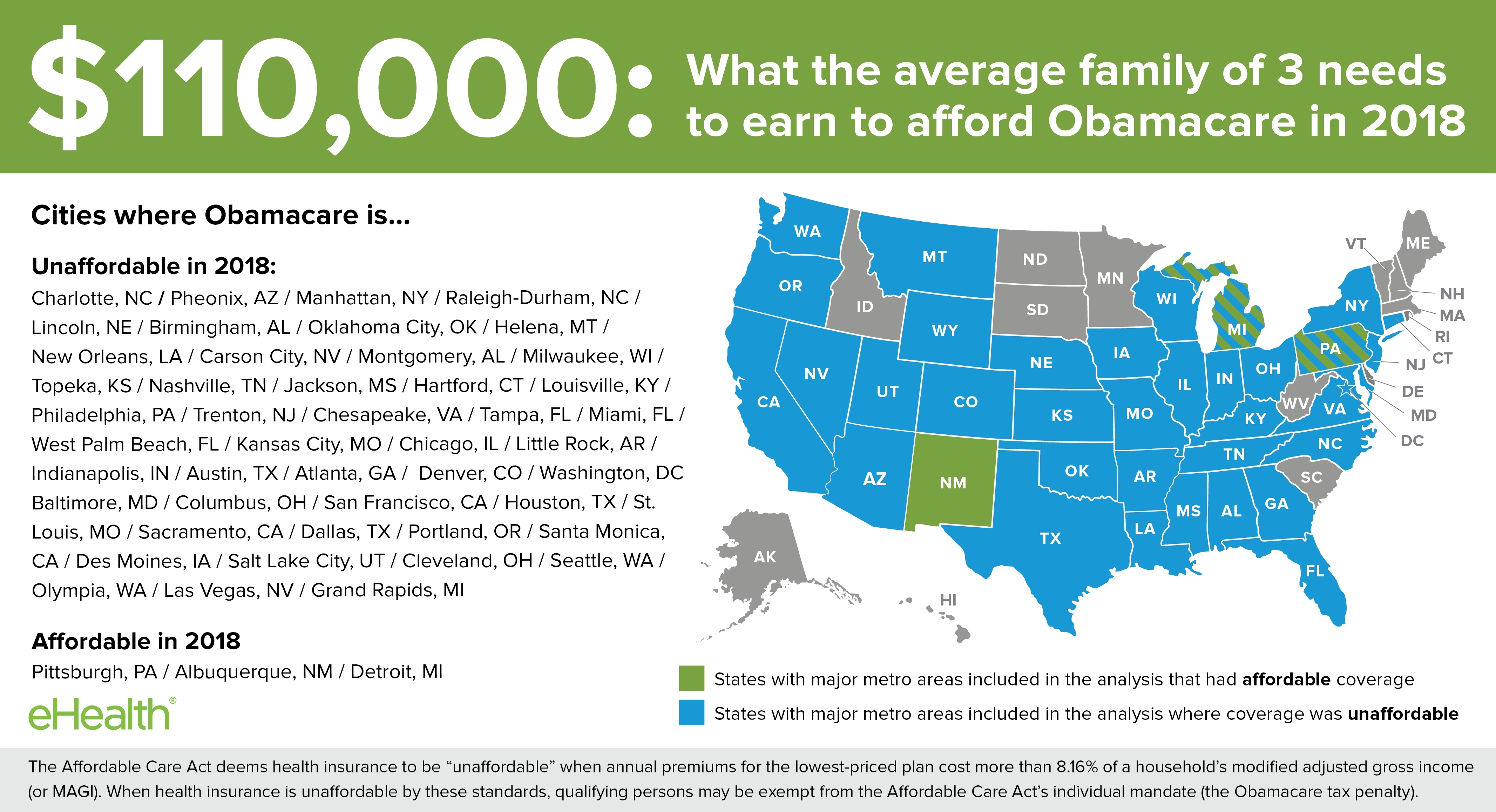

Affordable Care Act Health Insurance Will Be Unaffordable In 2018 For Many Middle Income American Families Ehealth Analysis Shows Business Wire

Affordable Care Act Health Insurance Will Be Unaffordable In 2018 For Many Middle Income American Families Ehealth Analysis Shows Business Wire

Household Size And Income Coverage And Tax Family

Household Size And Income Coverage And Tax Family

Aca Open Enrollment If You Are Low Income Kff

Aca Open Enrollment If You Are Low Income Kff

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Tax Time

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Tax Time

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

Aca Coverage Expansions And Low Income Workers Issue Brief 8886 Kff

0 Yorumlar